No Retainer Fee – Indian Buy Side | India – US Outbound M&A Q2 2025 – Report

Ascento is offering its services on a success fee basis to Indian public companies interested in US acquisitions in tech sector. We provide a spread sheet with 50-100 targets. Determine the market valuation and contact the ones approved by the client. We are confident that we will find a match. We hope to build a relationship and reputation in Indian buy side market. Below is a research report on Q2 2025 outbound M&A transactions from India to the U.S.

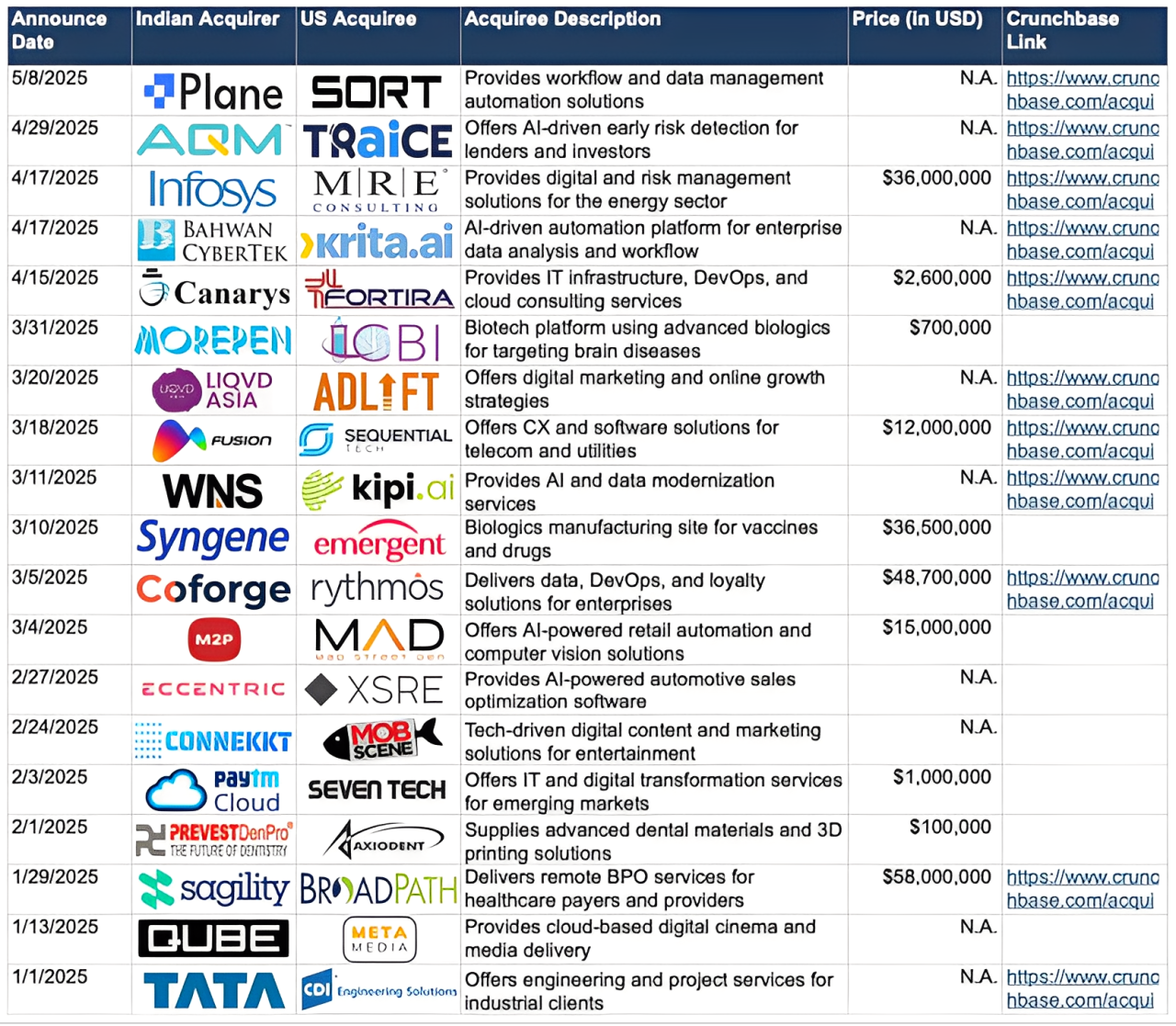

Q2 2025 Outbound M&A Transactions

In 2025, large Indian firms like Infosys and Coforge led high-value acquisitions of US tech companies to boost their digital transformation and innovation capabilities. Smaller Indian companies, which dominated deal count in Table 1 below, focused on acquiring specialized technologies in AI, cloud, biotech, and digital marketing to quickly expand their tech footprints in targeted sectors. This surge in outbound M&A highlights Indian firms’ strategy to leverage US innovation for accelerated growth.

Ashiss Kumar Dash, Executive Vice President of Infosys, commented on the $36M MRE Consulting acquisition: “At Infosys, we are witnessing a significant rise in demand for digital transformation in energy and commodity trading and risk management (E/CTRM). By combining MRE Consulting’s deep E/CTRM capabilities with Infosys’ established leadership in the energy, resources and utilities sector, we are further enhancing our ability to drive value for our clients in this critical area of their business.” (PR Newswire 4/17/2025).

Canarys CEO and Executive Director Sheshadri Srinivas commented on the $2.6M Fortira acquisition: “Fortira’s strong relationships in the BFSI, Healthcare, and Pharma sectors will further enable Canarys to drive seamless market penetration with its solutions-driven approach. This partnership not only accelerates our growth strategy but also strengthens our expansion plans in the North American market.” (PR Newswire 4/22/2025).

CEO of Plane Vamsi Kurama commented on the acquisition of Sort XYZ: “Bringing the Sort team into Plane and expanding into the U.S. are meaningful steps as we scale both our technology and our community. Our focus remains on building a platform that’s not just open-core in principle, but also in practice – designed to give teams full ownership of their workflows, data, and future.” (CXO Today 5/9/24).

Indian / US Outbound M&A Tech Sector in 2025

The Target Matrix is created in the first 2 weeks. A sample Target Matrix is here:

Ben Boissevain also contributes articles to TechCrunch about international M&A: Key issues you should consider before signing an international merger deal

Why hire Ascento over other Investment bank? Shorter time to a deliver variety of options. Faster valuation determination. Less time spent on corporate-bill-generating correspondence, hence valuable market data is sorted and presented to client faster. Indian CEOs can determine fit or pass and move on to the next target and closer to an acquisition.

If you are interested in exploring your company’s corporate finance options, please contact:

Ben Boissevain, Founder

646-286-4589